stash invest tax documents

And infrastructure investments that attract and retain residents and businesses. Under Apex Username type 10- and the Stash account number located at the top of your 1099 proved by Stash.

The 1099-B is a tax form sent to you from Stash so that you can report any gains or losses from selling stocks mutual funds or EFTs during the year.

. Tax policies and land use impacts Freight system planning and policy I would like to co-host an ON TO 2050 workshop. Stash also prepares the relevant tax forms at no cost. You can enter 4 lines and cover the entire form.

Each plan includes the option to open a brokerage account and a bank account. This form is relevant for all Stash investors who invested in certain ETFs even if you no longer hold this investment. Tuesday June 28 2022.

You CAN import all your tax information into TurboTax from Stash. Now you can automatically upload your Stash tax documents with TurboTax. In general if you hold your investments for longer than a year you will avoid paying short term capital gains taxes.

The Corrected Consolidated 1099 form replaces any other 1099s made available to you previously. Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser. It says they may not be posted until February.

You made a withdrawal from your Stash Retire IRA of 10 or more or. If unsuccessful youve likely selected the incorrect entry screen. The service has no account minimum though managed Smart Portfolios require 5 to get started and charges 1 to 9 a month depending on.

Stash Invest accounts are taxable brokerage accounts. However Stash Invest accounts are taxable brokerage accounts and you are required by the IRS to report income earned from capital gains and other applicable distributions. The tax documents are released in the month of February the year after the account is opened.

Have 2021 tax documents shown up in anyones account yet. 1099-DIV 1099-B etc at the top of pg. Products offered by Stash Investments LLC and Stash Capital LLC are Not FDIC Insured Not Bank Guaranteed and May Lose Value.

In Illinois municipalities receive state. If you have tax documents available. Requests for an Estate Tax refund must be made on a Petition for Estate Tax Refund Form PDF fill-in form.

You received more than 10 in interest on your Stash Invest account. You received dividend payments greater than 10 from your Stash Invest investments in 2019. It also negotiate lower overall.

Each year Stash will send you tax documents so that you can file your taxes appropriately. The administrator executor trustee etc and the form must be notarized before being mailed to our office at the above Springfield address. Each year Stash will send you tax documents so that you can file your taxes appropriately.

So just a heads-up for those of you waiting on this to file your taxes. Click Tax Documents now youve got the documentation you need to declare any income or loss you may have realized from the previous tax year. If you have tax documents available well send you an email.

Investment managers preparing the annual filings of Form 5500 for the US. Stash Invest Promotion Get 20 bonus stock with this referral link. Take a few minutes to read our community guidelines.

I just checked my account and tax documents are finally available for 2019. And heres a bonusTurboTax offers Stashers up to 20 off federal tax prep. Scroll down to the Documents section and click Portfolio.

Stash Invest accounts are taxable brokerage accounts. You received dividend payments greater than 10 from your Stash Invest investments in 2021. This form is sent to you by Stash if you earned more than 10 in dividends from EFTS or mutual funds OR if you earned any divided directly from a stock.

So if the account was opened in summer of last year the first tax statement is prepared in February of this year. The Password will be your SS. Market data by Thomson Reuters Refinitiv.

What Tax Forms Does Stash Send. You are required by the IRS to report income earned from capital gains and other applicable distributions. Review the tax documents provided by Stash.

For my tax document a lot of Date Acquired box 1b information are. Each year Stash will send you a tax statement so that you can file your taxes appropriately. Copy or screenshot your account number and type of tax document is.

Stash is not a bank or depository institution licensed in any jurisdiction. You sold an investment in your Stash Invest account in 2021. As the leader in tax preparation more federal.

For the 2019 tax year you can access those forms here. The easiest way to do this is through the Stash app under SettingsStatements and DocumentsTax Documents. If you have a Stash account Stash will provide you with the forms you need regarding your investments.

Type Apex and select Apex Clearing. This was my first year trading etrade and robinhood both say Feb 15th. The taxpayer filed its Illinois income tax return Form IL-1120 for 1988 on a combined basis with numerous corporations that are members of its unitary group.

You sold an investment in your Stash Invest account in 2021. 2019 Tax Documents Now Available. Each plan includes Financial Counseling services which is impersonal investment advice as it relates to guides reports and education material about investing and financial planning.

Taxpayer filed an amended Illinois income tax return Form IL-1120-X for 1988. Come talk about Stash investing and personal finance. Its under Statements and Tax Documents once you click on your name at least on Desktop.

Get started with. Completed forms must be signed by the duly appointed representative of the estate example. You may not have 2021 tax documents for.

10k life insurance offered by Avibra. Is a digital financial services company offering financial products for US. You will have tax documents from Stash if you.

The amount of tax revenue municipalities collect depends on the composition of the tax structure. Navigate to the account type you are looking for documentation on. If you have tax documents available well send you an email.

This is a tax form that consolidates all appropriate 1099 forms for your Stash Invest account into one single form. You are required by the IRS to report income earned from capital gains and other applicable distributions. You should have tax documents from Stash if.

Stash aims to make investing approachable for beginners.

What Do I Need To File My Tax Return

Should You Claim 0 Or 1 When Filing Out A Tax Form Personal Financial Planning Tax Finances Money

How To Organize Important Paperwork

Filing Cabinet Organization How To Organize All Your Important Paperwork

Home Improvements You Can Tackle With Your Tax Return Filing Taxes Tax Return Freedom Debt Relief

Stock Photo Two Business Meeting Professional Investor Working Together With Smart Phone And Laptop And D Meeting Professional Digital Tablet Business Meeting

Paper Organization How Long Should I Keep It Free Printable Clean Mama

Check The Monthly Account Statement And Balance The Portfolio Affiliate Account Monthly Check Portfolio Financial Documents Investing Accounting

Acorns Taxes Explained How To File Your Acorns App Taxes On Turbotax Youtube

Find Out How Long It Takes To Get Approved For A Credit Card Credit Card Application Small Business Credit Cards Business Credit Cards

Freebie Home File Organization Categories Template Sheets

Employment Pay Stubs 101 Is My Employer Required To Give Me A Pay Stub Small Business Tax Deductions Business Tax Deductions Deduction

Pay Your Personal Income Tax Norcross By Hiring Personal Agents Capital Gains Tax Accounting How To Plan

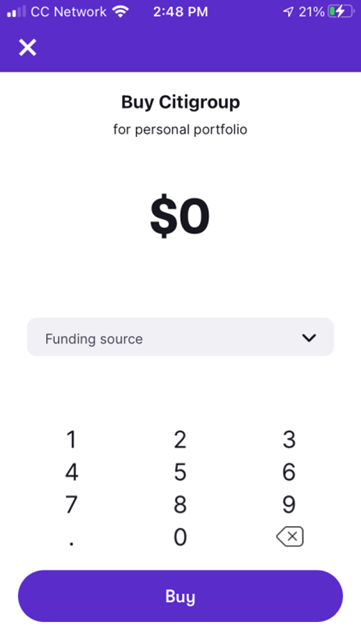

Stash Invest App Review 2021 Warrior Trading

You Still Have Time To Reduce Your Tax Bill For 2019 The Motley Fool The Motley Fool Still Have Tax